Empowering Smarter Workforce Decisions

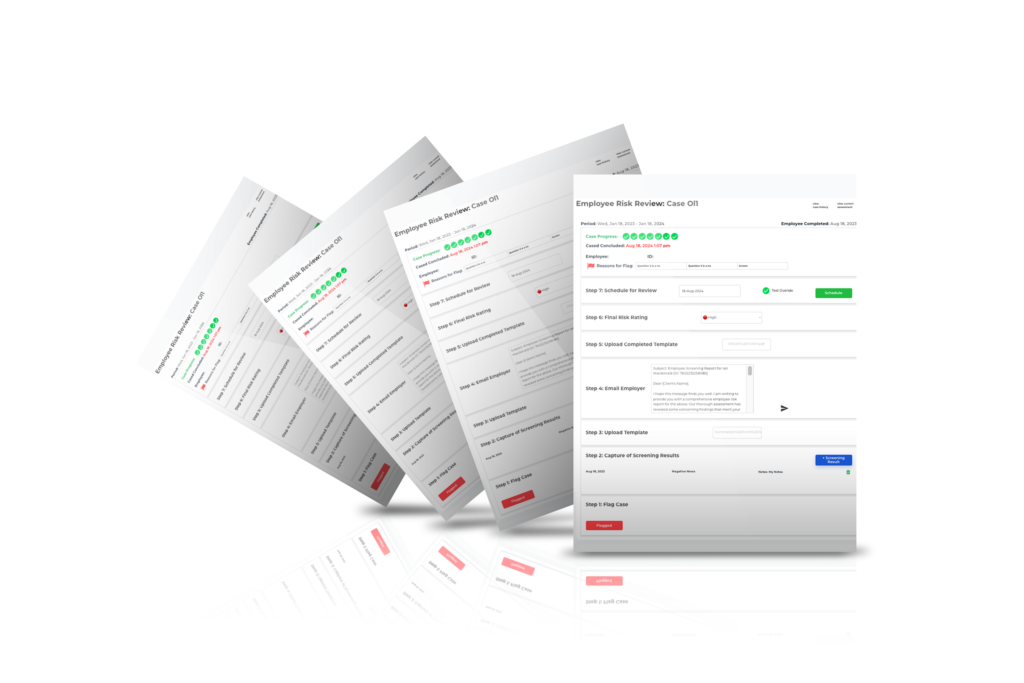

Our Automated Workflow Solution Allows You To Screen, Risk-Rate And Manage Employee Risk.

Securely Store Employee Information And Documents

Conduct Background Checks, Qualifications,Sanctions And PEP Screening

Complete Annual Compliance Declarations: Gifts And Entertainment; Remote Working; Outside Interests

Receive Alerts On Anomalies And Ongoing Reviews

Track Decisions And Approvals

Receive Support From A Dedicated Outsourced Onboarding Team

Our Tool Is A Modern, API Enabled Cloud-Based Platform Which Streamlines Your Employee Compliance Procedures, Securely Stores Your Employee Data And Produces Accurate Reports.

Bulk Upload Employee Information Or Send Out Personalized Links For Employees To Upload And Maintain Their Own Information.

- Identify and assess potential risks associated with employees

- Evaluate individual risk factors such as criminal records, sanctions listing, conflicts of interest, gifts and entertainment, remote working

- Risk rating tool, triggers and ongoing due diligence

- Streamline employee compliance tracking and reporting

- Ensure adherence to legal and regulatory requirements

- Minimize the risk of penalties and reputational damage

- Monitor employee behavior patterns and trends

- Enable early intervention and corrective actions

Got Your Own Employee Risk Management Tool?

Let Our Team Take Care Of The Operational Aspects Using Your Own Employee Risk Management Tool. We Will Review Prospective And Existing Employee Information And Documentation, Conduct Screening And Background Checks, Risk Rate And Provide You With The Results Of The Assessment. It’s Like Having Your Own Onboarding Team Taking Care Of Your Employee Risks.

Screening employees is crucial for organizations to ensure the integrity, trustworthiness, and suitability of individuals before they are hired or given access to sensitive information or critical responsibilities.

Here’s why vetting employees should form part of your risk management process:

👉 Hiring individuals with appropriate credentials, qualifications, and ethical standards helps protect the reputation and brand of an organization. Employees are representatives of the company, and their actions can significantly impact its image and public perception. Screening employees helps mitigate the risk of hiring individuals with a history of misconduct or behaviors that could harm the organization’s reputation.

👉 Many organizations deal with sensitive and confidential information, such as trade secrets, customer data, or intellectual property. Vetting employees helps ensure that individuals with access to such information can be trusted to maintain its confidentiality. This reduces the risk of data breaches, leaks, or unauthorized disclosure of sensitive information.

👉 Compliance with Legal and Regulatory Requirements: Certain industries have stringent legal and regulatory requirements for employee screening. For example, organizations in the financial sector are often required to conduct background checks to comply with anti-money laundering and know-your-customer regulations. Screening employees helps organizations adhere to these requirements and avoid legal penalties or reputational damage.

Key requirements that institutions need to consider:

Risk-Based Approach:

- Institutions should adopt a risk-based approach to employee screening. This means tailoring the level and frequency of screening based on the risk associated with specific roles.

- Higher-risk roles (such as those with direct access to financial transactions) require more frequent screening, while lower-risk roles may need less frequent checks.

Prospective Employees:

- Before hiring new employees, accountable institutions must conduct thorough background checks.

- Key requirements include verifying identity, assessing qualifications, and scrutinizing employment history.

- The goal is to ensure that prospective employees have the necessary competence and integrity to perform their roles effectively.

Ongoing Screening for Current Employees:

- Regularly screening existing employees is essential.

- Institutions should periodically review employee information against targeted financial sanctions lists, watchlists, and other relevant databases.

- The frequency of checks should align with the risk associated with each role.

Record Keeping:

- Institutions must maintain accurate records of employee screening activities.

- These records should include details of the screening process, results, and any necessary follow-up actions.

Training and Awareness:

- Employees should receive training on AML, TF, and PF risks.

- They need to understand their responsibilities related to compliance and reporting suspicious activities.

- Regular awareness programs help reinforce the importance of vigilance and adherence to policies.